![]()

Update Chrome Browser

Foreign Company Registration in India | Wholly Owned Subsidiary Incorporation

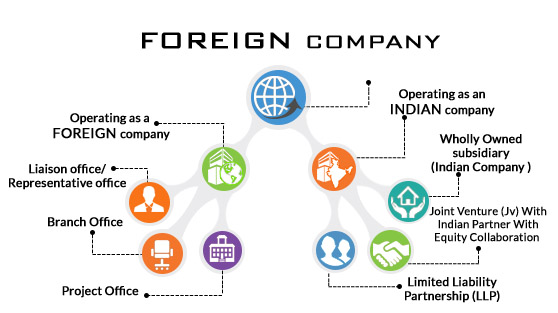

India is among the fastest growing economies of the world with plenty of business opportunities which make it a preferred destination for investment form NRIs, Foreign Nationals and Foreign Companies. There are many ways by which foreign investment can be done in India. One of the most successful and sought after ways is Incorporation of Foreign Subsidiary in India.

Meaning – Foreign Subsidiary company:

A subsidiary is a company with voting stock (that is more than 50%) controlled by another company, usually referred to as the parent company or the holding company. In cases where a parent company owns a foreign subsidiary, the subsidiary must follow the laws of the country where it is incorporated and operates. Hence, if a foreign subsidiary is incorporated in India, then it has to follow the applicable laws in India.

How to incorporate a Foreign Subsidiary in India?

Selecting the type of Company-

According to FEMA guidelines, Foreign Direct Investment (FDI) is not allowed in case of Proprietorship, Partnership Firm and One Person Company. Though investment in LLP’s is allowed, but it requires prior approval of the RBI.Foreign Company Registration

Hence, the easiest and fastest way set up a business in India by NRI’s and Foreign Nationals/entities is through incorporation of a Private Limited Company.

Minimum requirements-

Step 1. Obtaining DSC and DIN-

The first step towards Foreign Company Registration in India is applying for the DSC (Digital Signature) and DIN (Director’s Identification Number) of the Directors. The primary documents required for obtaining the DIN and DSC are as under:

All the above documents for foreign citizens and non-residents should be notarized and consuralized or apostilled by the competent authority, as the case may be.

Step 2. Name Approval:

Selecting a unique and acceptable name for the proposed Company is one of the important steps in the whole Incorporation process. The name should be in consonance with the Object of the Company and should not be identical to existing entities or Undesirable by Law.

Step 3. Incorporation Application:

This is the final step in the Foreign Company Registration process. It requires filing of the Memorandum Foreign Company Registration and Articles of Association of the Company digitally along with various other documents duly executed by the proposed directors and shareholders.

List of Incorporation documents to be executed:

Generally, the incorporation documents are required to be self-attested by Indian Nationals. However, in case of Foreign Nationals, the process is as under:

In the documents are signed outside India, then the same have to be notarized by a Public notary of the residence country and consularized or apostilled by the competent authority, as the case may be.

If the documents are signed in India, then copy of Visa and stamped passport, proving his/her presence in India at the time of signing is required.

If the subscriber is a foreign entity, then the Incorporation documents should be signed by the representative of the foreign entity. An Authorization Letter duly stating the name of the Authorized Person and the number of shares subscribed should be notarized, consularized or apostilled, as the case may be in the home country of the subscriber company.

Once the Incorporation application is approved, the Registrar would issue a Certificate with a Corporate Identification Number (CIN). The PAN and TAN of the Company would also be allotted simultaneously.

Treatment of Share Capital invested by the Holding Company and required compliances:

Foreign Investments in Indian Companies are regulated by FEMA Guidelines and the Reserve Bank of India. Whenever the holding company invests funds in the share capital of the Indian subsidiary, it has to follow RBI guidelines along with compliances under Companies Act 2013.

RBI Compliances:

A two-stage reporting procedure is to be followed when a company is raising funds from a foreign investor:

– A Certificate from the Company Secretary certifying that the company has complied with the procedure for issue of shares as laid down under the Foreign Direct Investment (FDI) Scheme, and,

– A Valuation Report From Merchant Banker indicating the manner of arriving at the price of the shares issued to the foreign investors.

Apart from the above, Annual return on Foreign Liabilities and Assets is required to be submitted reporting all the investments received during the year.

Whenever an Indian Entity receives funds from Foreign Nationals and Foreign entities or NRI’s (from their NRE Account), various RBI and FEMA Compliances have to be checked, analysed and complied to ensure proper approvals and reporting as per the existing laws.

For instance, when foreign funds are received in the form of Share Capital, then a two-stage reporting procedure is to be followed on receipt of funds as well as on Allotment of Shares.

When funds are received in the form of loan, then it would amount to “External Commercial Borrowings” (ECB) and both RBI regulations and FEMA guidelines will be applicable on the company. ECB’s refer to commercial loans in the form of bank loans, buyers’ credit, suppliers’ credit and shareholder’s loans availed by an Indian borrower from non-resident lenders. There are various terms and conditions to be followed if ECB’s are availed as per law.

2S services experts provide all such RBI and FEMA Compliance advisory and services to ensure that you are fully compliant when entering into such transactions.

The company has to provide details in an “Advance Reporting Form” to the RBI within 30 days of receiving funds from investor(s). Also, the company has to issue shares within 180 days from receiving funds otherwise it would lead to violation of the FEMA regulations.

On issue of shares to foreign investors, the company has to report in specified form (FC-GPR) to the RBI, within 30 days from the date of issue of shares along with a Certificate from the Company Secretary and a certificate from a Chartered Accountant.

While availing ECB’s, it is primary to check whether the Company is eligible to obtain ECB’s as per the RBI guidelines. There are conditions on the amount to be remitted every year, restrictions on the end use of the money, average maturity period, so on and so forth.

Under FEMA, Form 83 has to filed for obtaining a loan Registration Number and the such filings and reporting are to be carried out every month in Form ECB2.

It is mandatory for a foreign subsidiary company to meet all compliances as there can be severe consequences if they fail to do so. The failure to meet required compliances may result in the company being fined, being levied penalties and can also lead to criminal charges with imprisonment under relevant provisions of applicable law(s). The following are the penalties that may be levied against a company for not meeting their compliances:

– Under Section 392 of the Companies Act 2013 (effective from April 1, 2014):

1. Notwithstanding anything given under Section 391, if a foreign company is found to have contravened any provisions under Chapter XXII of the Act, the company will be punished by way of fine that shall be no less than Rs 1 lakh and may extend up to Rs 3 lakh. If the offence is continuing, then a fine of Rs 50,000 will be added for every day, the offence continues.

2. Every officer of a foreign company who is in default is punishable by imprisonment for a period of up to 6 months and/or a fine of minimum Rs 25,000, which may extend to up to Rs 5 lakh.

It is important for a company to meet all its compliances to ensure that they are able to continue with its business operations properly without the interference of the authorities.

The international aspects of income tax laws are termed as international taxation. It includes taxation of Resident Individuals and Corporations on income arising in foreign countries and taxation of Non residents and Foreign Companies on income arising in India.

India has comprehensive Double Taxation Avoidance Agreements with various countries. The rate on which tax will be charged on international transactions depends upon the terms of the treaty (DTAA) with such other country.

2S services helps in determining the taxability of such international transactions and brings to you whole range of services in the matter of International Taxation ranging from Advance Ruling applications for Non-Residents & Foreign Companies, NRI Taxation, Advice on withholding taxes, Transfer Pricing etc. Our network of professionals has the resources, experience and competencies to help companies address all the aspects of their cross-border needs.

Advance Ruling means pre – determination of tax liability in relation to an activity which is proposed to be undertaken by a non-resident setting up a venture in India or a foreign company which proposes to undertake any business activity in India. VenturEasy enables applicants to make applications for obtaining Advance Ruling in the manner prescribed by law

Form 15CB is the Tax Determination Certificate issued by a CA after examining the taxability of the foreign remittances with respect to the provisions of the Income Tax Act and Double Tax Avoidance Agreements with the Recipient’s Residence Country. Form 15CA and 15CB are furnished electronically and our experts can help you in preparation and submission of such forms easily.

DTAA means Double Taxation Avoidance Agreement. While determining the taxability of income arising in India to Non-residents or Foreign Companies, it is essential to refer to the DTAA with that country, if any, and calculate taxes in accordance with the terms of that agreement. VenturEasy experts assist in determination of correct tax liability after carefully understanding the terms of DTAA.

VenturEasy provides Transfer Pricing services for effective solutions to companies which undertake international transactions or specified domestic transactions with its associated enterprises or group companies. We assist in preparing Transfer Pricing Reports which is to be furnished on or before the filing of the income tax return which is 30th November following the end of the financial year

If you are an NRI (Non Residential Indian), you are only liable to pay taxes for the income that is earned in India. There are various sections under Income Tax, Service Tax and FEMA, which directly impact the taxation issues of NRI’s.

Withholding taxes are required to be deducted by the person making payment to a Non-Resident or Foreign Company in respect of any sum taxable under the provisions of the Income Tax Act. Such tax has to be deducted at rates prescribed under relevant Finance Act or at the rates prescribed in Double taxation avoidance agreement (DTAA), whichever are beneficial to the assesse.

For a foreign Investor in India it is very important to choose a right kind of business or corporate entity which best suits its purposes and takes care of liability issues and tax planning issues. Foreign Companies planning to do business in India should pay special attention to Entry Strategies in India for Foreign Investors and corporate structuring to save taxes to the best extent allowed by laws and international tax treaties.

It is also mandatory for foreign investors or foreign shareholders, both individuals and corporate shareholders, to seek Government Approvals for Investing in India In some special cases Foreign Investment Promotion Board, FIPB Approval for Foreign Investment in India is required. In other cases Reserve Bank of India, RBI Approvals for Foreign Investment in India is required. The sectors where RBI Approval for foreign investors is available under automatic route can be found at FDI in India Sector wise Guide.

There are various steps required to establish a business in India, before and after incorporation, as mentioned hereinafter. See also the Procedure for Formation of Company in India. See also USA Company forming a subsidiary in India.

Private Limited Company is the most popular form of business entity among foreign investors, including USA investors, to form a subsidiary, a joint venture or 100% owned company in India.

Foreign investors planning to open a subsidiary in India are required to seek governmental approval before investing in India. Some approvals are automatic, – RBI Approvals – though application is required for those approvals. Special Permission – FIPB Approvals – could be obtained to invest over and above the regular percentage allowed. See our FDI in India Sector wise Guide for more information on various conditions of investing in India. Also see Withholding Tax Rates For Foreign Companies Doing Business In India Under The Tax Treaties & the Joint Ventures in India

Contact us for incorporating in India & setting up business in India

To incorporate a private limited company, a minimum of two shareholders are required. A minimum of two shareholders and a maximum of up to 200 shareholders are allowed in a private limited company. The shareholders could be natural persons or companies, including foreign companies.

A private limited company must have a minimum of two Directors and can have up to a maximum of fifteen Directors.

The Director needs to be over 18 years of age and must be a natural person. There are no limitations in terms of citizenship or residency. Therefore, foreign nationals can be directors in a Indian Private Limited Company.

Minimum authorized capital of Indian Rupees 100,000 (US $ 2250 approximately) is required to form a private company in India. There is no upper limit.

Is an office required for starting a Private Limited Company?

An address in India where the registered office of the Company will be situated is required. The premises can be a commercial / industrial / residential where communication from the MCA will be received.

No, you will not have to be present in India for registering of a Private Limited Company.

Identity proof and address proof is mandatory for all the proposed Directors of the Company. PAN Card is mandatory for Indian Nationals. In addition, the landlord of the registered office premises must provide a No Objection Certificate for having the registered office in his/her premises and must submit his/her identity proof and address proof. Memorandum of Association and Articles of Association and other documents are prepared by us.

We can incorporate a Private Limited Company in India from 2 to 6 weeks. The time taken for registration will depend on submission of relevant documents by the client and speed of Government Approvals. To ensure speedy registration, please choose a unique name for your Company and ensure you have all the required documents prior to starting the registration process.

Yes, the process can be expedited if all the paperwork is signed and authenticated faster, and the proposed name of the Private Limited Company is very unique. Names that are similar to an existing private limited company / limited liability partnership / trademark can be rejected and additional time will be required for re submission of names.

A Digital Signature establishes the identity of the sender or signee electronically while filing documents through the Internet. The Ministry of Corporate Affairs (MCA) mandates that the Directors sign some of the application documents using their Digital Signature. Hence, a Digital Signature is required for all Directors of a proposed Company.

Director Identification Number is a unique identification number assigned to all existing and proposed Directors of a Company. It is mandatory for all present or proposed Directors to have a Director Identification Number. Director Identification Number never expires and a person can have only one Director Identification Number.

Once a Company is incorporated, it will be active and in-existence as long as the annual compliances are met with regularly. In case, annual compliances are not complied with, the Company will become a Dormant Company and maybe struck off from the register after a period of time. A struck-off Company can be revived for a period of up to 20 years.

A private limited company must hold a Board Meeting at least once in every 3 months. In addition to the Board Meetings, an Annual General Meeting must be conducted by the Private Limited Company, at east once every year. For details see: Corporate Compliance in India

Yes, a Foreign National or an NRI can be a Director in a Private Limited Company in India after obtaining Director Identification Number. However, at least one Director on the Board of Directors must be a Resident India.

Yes, a Foreign National or an NRI Foreign Companies can hold shares of a Private Limited Company subject to Foreign Direct Investment (FDI) Guidelines.

Yes, Foreign Companies can hold shares of a Private Limited Company in India subject to Foreign Direct Investment (FDI) Guidelines. Please see the FDI Guidelines for various sectors.

Yes, Foreign parent or holding Companies, including USA parent companies, can incorporate a subsidiary, as a 100% owned Private Limited Company in India subject to Foreign Direct Investment (FDI) Guidelines. Please see the FDI Guidelines for various sectors.

100% Foreign Direct Investment is allowed in India in many of the industries under the Automatic Route. There are called RBI Approvals – if the percentage allowed for various Sectors is met. However, an application for approval is required for automatic approvals.

Special Permission – FIPB Approvals – could be obtained to invest over and above the regular percentage allowed for various Sectors.

For Steps involved see: Steps for Forming Private Limited Company in India

Besides incorporation there are many other formalities in establishing a business in India. For other requirements for establishing business in India, see: Other Steps to Establish Business in India.